But what additional value can time bring to the watch ? Do all models possess the same potential ? Let us guide you through this article as we explore the answers to these questions and much more.

How is additional value forming ?

Brands of the timepieces in the top 100 most expensive watches ever sold at auction

I can already hear you objecting, quite rightly, that most of these watches would have been out of reach for the vast majority of us from the day they were first purchased.

Nevertheless, the logic that makes the resale of these prestigious timepieces so profitable also guides the resale of more affordable ones.

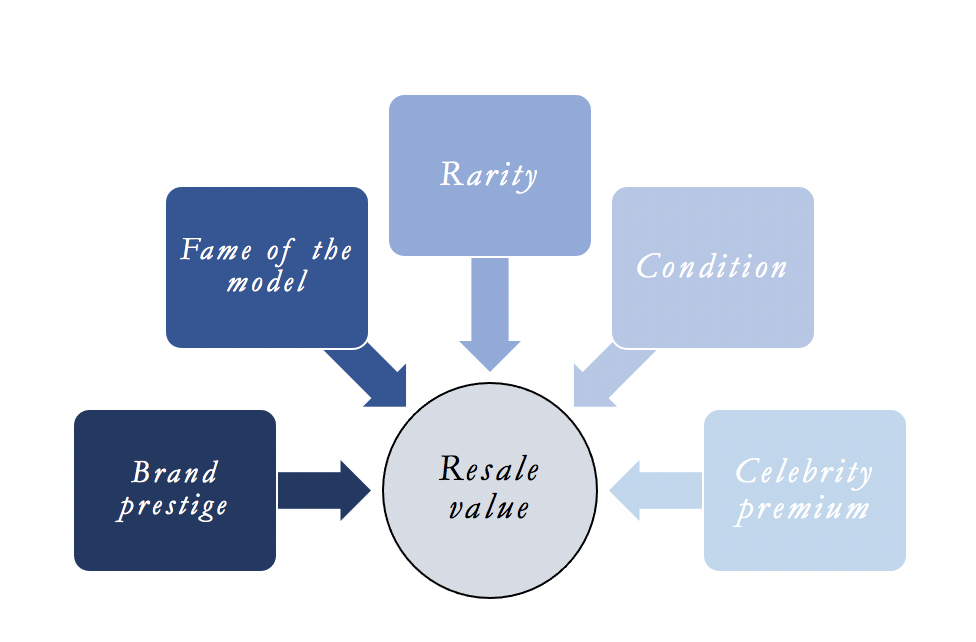

As the over-representation of Patek Philippe watches in the ranking shows it, the rarity criterion combined with the prestige of the brand are major forces in determining the resale price.

Indeed, the oldest the model, the more probable it is that modifications or upgrades to its mechanism or design will have been made, with the consequence that the original piece will only be made available on the secondary market. Then, naturally, the rarity of the remaining well-preserved models will only increase.

In the same way, stopping the production of a watch can only help to make it more valuable, but there is no guarantee.

Finally, the condition of the watch is a variable not to be neglected, and if you intend above all to make your timepiece an investment object, it would be better to take great care of it or to keep it safe from any impact and deterioration. A second-hand watch in “as new” condition can indeed be sold with a 15% to 30% premium compared to a more altered one (2).

In the same way, you should make sure to keep the original box and papers as they allow you to easily prove that your timepiece is not counterfeited. Sellers who cannot provide them should expect an average 20% drop in the resale price of their watch (3).

For example, the head of Sotheby’s watch division told the New York Times that she once supervised the auction of a Rolex Daytona whose aged black dial had developed a brown tint over time. The final sale price for this watch reached $950,000 all costs included. As a comparison, it had been purchased in the 1970s for a few hundred dollars and the regular unaltered Daytona model from this timeperiod is valued at around $150,000 (4).

Rolex Daytona 6263 with altered “tropical” dial

A significant part of affect ?

As an example, the mythical Rolex Daytona only started to experience a dramatic increase in its value at the end of the 1980s, even though the model had been around since 1963 and had seen Paul Newman wearing it as early as 1972. For almost 25 yeats after its release, Rolex even had troubles selling the exotic dial “Paul Newman” Daytona. However, it is today the most coveted version of the model.

While the brand confers an undeniable and particular aura to its timepieces, some models sometimes acquire a specific recognition and image through their marketing positioning, celebrities they are associated with or through particular events linked to their history.

Rolex Submariner

First launched in 1953 as the first water-resistant wristwatch down to 100 meters. It was notably popularized by its recurring appearance in « James Bond » movies until 1989, and was featured on the wrists of Sean Connery, Roger Moore and Timothy Dalton.

First launched in 1953 as the first water-resistant wristwatch down to 100 meters. It was notably popularized by its recurring appearance in « James Bond » movies until 1989, and was featured on the wrists of Sean Connery, Roger Moore and Timothy Dalton.Rolex Daytona

Launched in 1963. The Daytona is named after a famous Florida city known for its car racing competitions on the Daytona International Speedway circuit. Even though it was initially designed for professional racing drivers, the model was nevertheless popularized by personnalities such as famous actor and circuit enthusiast Paul Newman.

Launched in 1963. The Daytona is named after a famous Florida city known for its car racing competitions on the Daytona International Speedway circuit. Even though it was initially designed for professional racing drivers, the model was nevertheless popularized by personnalities such as famous actor and circuit enthusiast Paul Newman.Tag Heuer Monaco

Launched in 1969, in tribute to the famous Monaco Grand Prix. The watch created curiosity with its original square case design and Grand Prix colours: blue, red and white. The model was popularized by actor and pilot Steve McQueen who adopted it for the shooting of the movie “Le Mans”, set on Le Mans 24-hour circuit, and released on screens in 1971.

Launched in 1969, in tribute to the famous Monaco Grand Prix. The watch created curiosity with its original square case design and Grand Prix colours: blue, red and white. The model was popularized by actor and pilot Steve McQueen who adopted it for the shooting of the movie “Le Mans”, set on Le Mans 24-hour circuit, and released on screens in 1971.Omega Seamaster

The Seamaster is a venerable model launched in its first version in 1948. The series appealed to the public with its refined and sporty design, based on the watches provided to British naval officers during the Second World War. The Seamaster was also popularized by its appearances in “James Bond” movies since 1995, appearing on the wrists of Pierce Brosnan and Daniel Craig.

The Seamaster is a venerable model launched in its first version in 1948. The series appealed to the public with its refined and sporty design, based on the watches provided to British naval officers during the Second World War. The Seamaster was also popularized by its appearances in “James Bond” movies since 1995, appearing on the wrists of Pierce Brosnan and Daniel Craig.

Watches that have been owned by celebrities are also auctioned off at usually large but highly variable celebrity premiums (from 892% for Elvis Presley’s Omega timepiece (5) to nearly 36,000% for a watch of the same brand that once belonged to US President John F. Kennedy (6)).

It also appears that the differential with the initial retail price can increase significantly over time. Indeed, Eric Clapton’s Rolex Daytona Oyster Albino, first sold by the artist in 2003 for $505,000, was auctioned off again in 2015 for almost $1,400,000 (7), thus twice breaking the record for highest price ever paid for a second-hand Rolex watch !

Time Premium factors

What are the most popular brands and models among investors ?

Unsurprisingly, almost all articles written on the subject of investment watches systematically mention the same pair of brands : Rolex and Patek Philippe.

Recurring references to major brands such as Audemars Piguet, Omega and also F. P. Journe are also made. The latter, even though it is not as famous as some others, is mostly characterized by the extreme precision of its mechanisms and the rarity of its chronometers, of which less than a thousand are manufactured each year.

Would you possibly have in mind some of the models that figure among the most coveted by investors?

First model :

Rolex Daytona

You would be absolutely right to think about the Rolex Daytona. Indeed, several series such as the Submariner or the GMT-Master might be in good position, but none of them arouses as much passion as the emblematic Daytona. At first popularized by actor and race driver Paul Newman, it is today considered to represent the prime example of a sports watch. The Paul Newman models, dating back to the end of the 20th century, experienced the strongest appreciation but the mechanical stainless steel model also went through a sharp increase in its value. The Collector Square website indeed estimates the auction purchase price of a Daytona mechanical steel at around CHF 20,800 in 2002, compared to almost CHF 102,900 in 2018, therefore representing a 390% premium net of inflation ! The Daytona automatic steel based on the Zenith movement was also subjected to a price increase of nearly 140% net of inflation over the same period and reached the price range of CHF 22’000 to 27’500 (8).

-

Daytona 6239, 1963

-

Daytona 116520 black dial, 2000

-

Daytona 116520 brown dial, 2000

Second model :

Patek Philippe Nautilus

The Patek Philippe Nautilus also constitutes one of the timepieces most sought after by investors and collectors. The reference 5711 in particular is regarded as the ultimate Patek Philippe model. Waiting lists to acquire the watch are reputed to be considerably long. Canadian millionaire Kevin O’Leary confessed that he waited nearly 10 years to finally be able to wear his Patek Philippe Nautilus. The model has subsequently taken on a much higher value on the second-hand market due to the long waiting time required to obtain it. Although the suggested retail price is CHF 27,000 on the official Patek Philippe website, it is not sold for less than CHF 54,000 on Chrono24 online watch sales platform, thus representing a 100% markup !

-

Nautilus 3700, 1976

-

Nautilus 5711, 2006

-

Nautilus 5711, 2006

Third model :

Omega Speedmaster

Just as illustrious, the Omega Speedmaster watch enjoys an extraordinary and timeproof image : that of the first timepiece on the Moon. After coming on top of a set of trials, the chronograph was adopted in the 1960s by NASA as the official traveling companion of all astronauts. The Speedmaster was worn by Buzz Aldrin during the famous Apollo 11 mission on the moon and thus made history. The specialized website Collector Square estimates that the price of all Speedmaster vintage models combined tripled over the past decade. The first series launched in 1957 remains the most popular and is worth several tens of thousands. Models such as the Speedmaster reference 145022 are also highly coveted, and it is currently the most sold at auction for an average sale price of CHF 4,500 over the last three years (9). The series occupies a unique position as it combines a competitive price making it affordable even to modest budgets with great value retention.

-

Speedmaster CK2915, 1957

-

Speedmaster 145022, 1968

-

Speedmaster Moonwatch Platinum, 2019

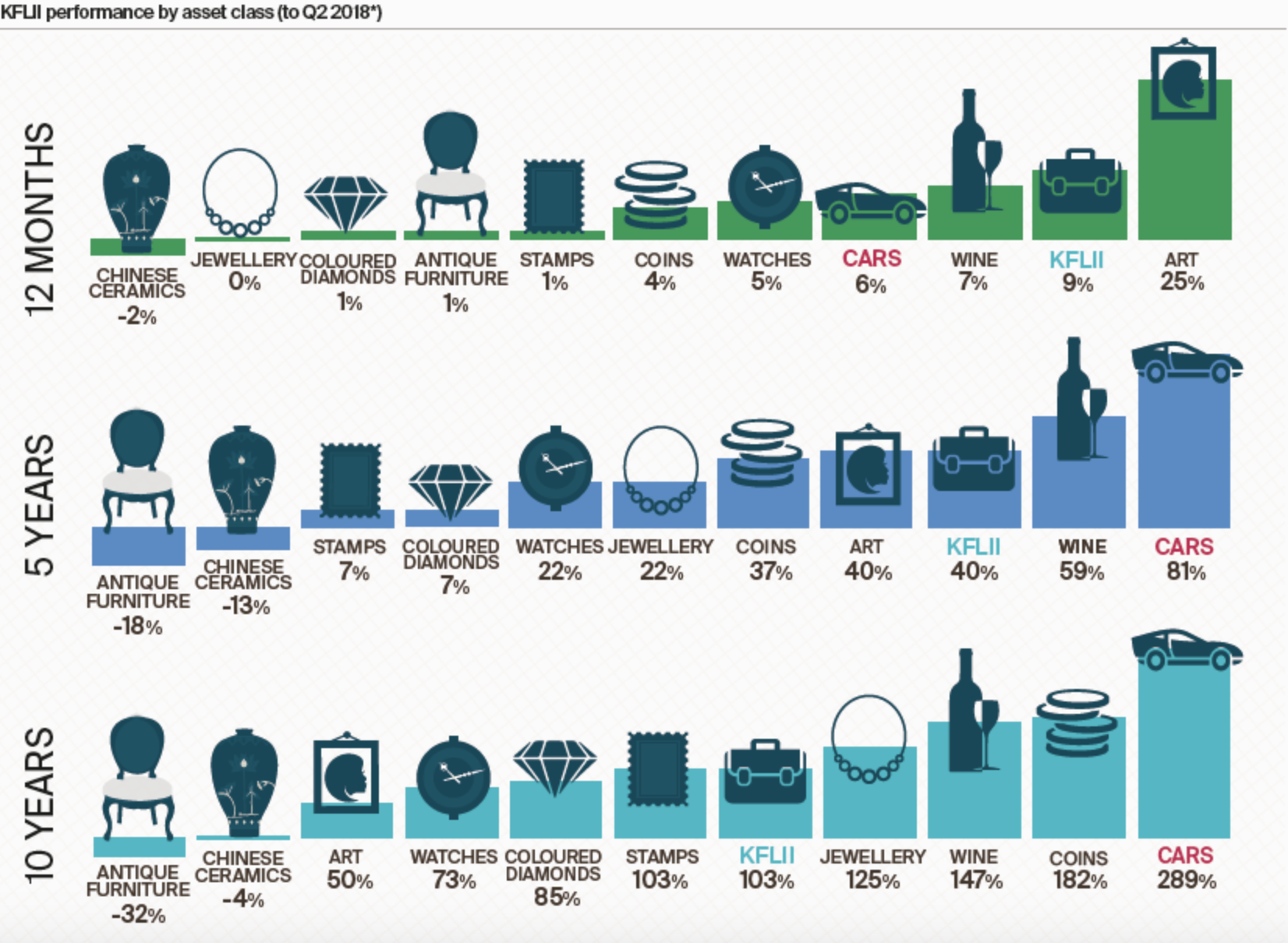

What are the yields in comparison to other luxury investments ?

We will be careful not to attest to this. However, another element could support as well that markets would have a newly found enthusiasm for luxury watches.

Indeed, among the top 100 most profitable watches ever sold at auction, as much as 31 timepieces made it into the ranking between 2017 and 2019.

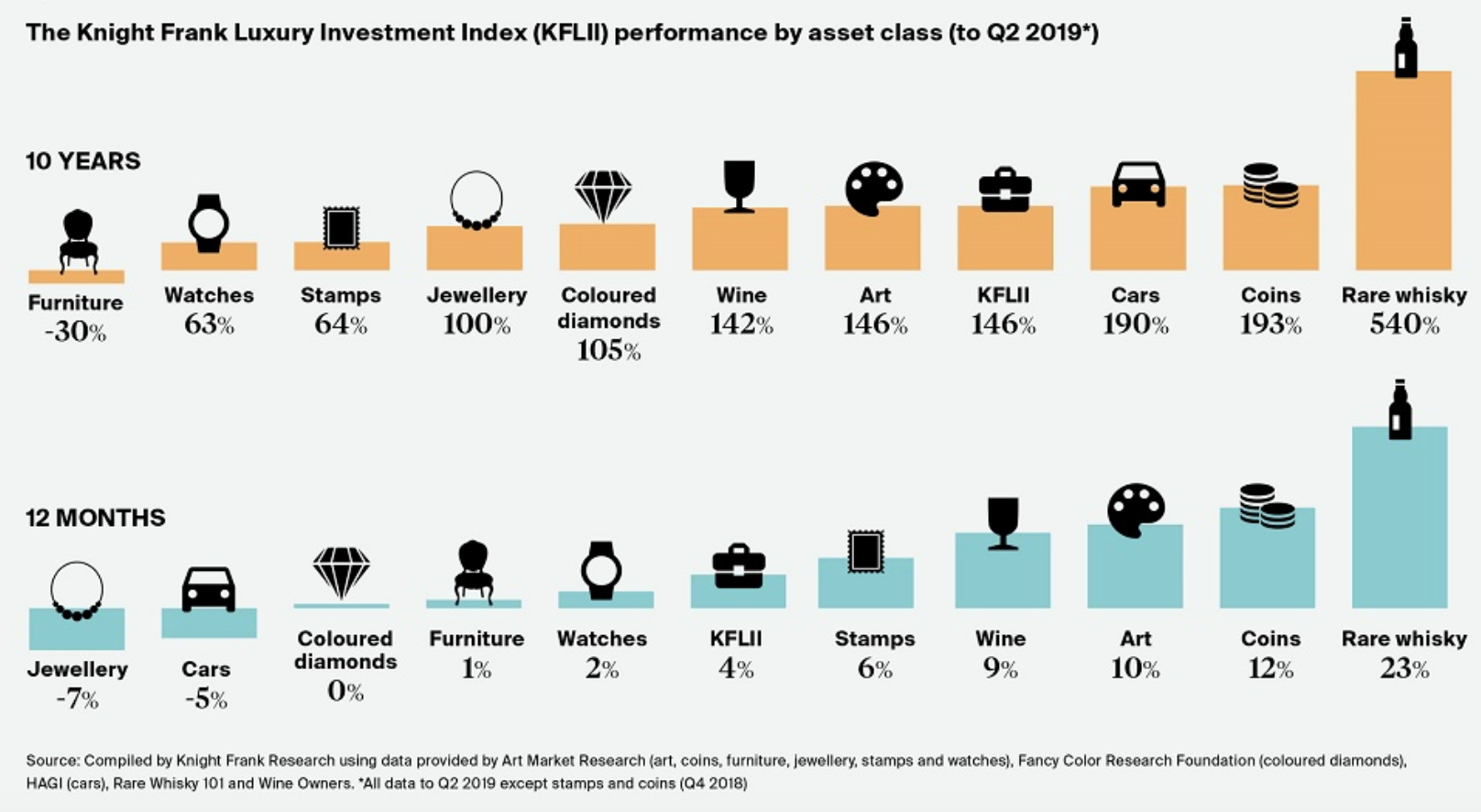

The latest Knight Frank index, established in Q2 2019, also illustrates the progression of investment watches in the ranking on recent time spans even though the reported yields remain modest. It would seem as well that watches do not make it anymore into the top 5 most profitable assets on the last 12 months.

But, beyond mere asset, the timepiece has an advantage that other investment classes such as wine or cars are deprived of : it is possible to fully enjoy it without depreciating its value, and its reliable mechanical operation can ensure its longevity for several generations while still gaining in value.

Maxime Pastore

References

- https://en.wikipedia.org/wiki/List_of_most_expensive_watches_sold_at_auction#Ranked_list_(as_of_December_2019)

- https://www.capital.fr/votre-argent/investir-dans-les-montres-elles-ne-prennent-de-la-valeur-que-si-elles-sont-tres-bien-conservees-1244451

- https://www.wpdiamonds.com/selling-watches-without-box-papers/

- https://www.nytimes.com/2018/05/25/your-money/watch-investment-auction.html

- https://www.omegawatches.com/fr/stories/the-king-s-omega-sells-for-record-price

- https://www.lepoint.fr/montres/omega-02-11-2013-1998900_2648.php

- https://www.forbes.com/sites/elizabethdoerr/2015/05/11/eric-claptons-rolex-daytona-6263-oyster-albino-and-steel-patek-philippe-smash-world-auction-records/

- https://www.collectorsquare.com/luxprice-index-montres.html

- https://www.collectorsquare.com/luxprice-index-montres.html

- https://www.knightfrank.com/blog/2018/06/05/wealth-report-2018-what-is-the-knight-frank-luxury-investment-index

Pictures References

- https://thewatchlounge.com/

- http://lepetitpoussoir.fr/

- https://www.vogue.fr/

- https://www.gqmagazine.fr/

- https://monochrome-watches.com/

- https://www.forbes.com/

- https://www.collectorsquare.com/

- https://www.rolex.com/fr/

- https://www.lepoint.fr/montres/

- https://bulangandsons.com/

- https://www.omegawatches.com/fr/

- https://www.knightfrank.com/